Merchant Frequently Asked Questions

-

Who is WeGetFinancing™?

WeGetFinancing is a real time Purchase Finance Gateway that enables consumers, who are in the process of making purchases either at their favorite participating merchants’ websites or brick and mortar locations, to obtain instant financing under the best possible terms from numerous lending sources.

-

What is WeGetFinancing?

WeGetFinancing is a multi-lenders platform that helps merchants offer instantaneous financing to customers of all credit types at checkout. Featuring WeGetFinancing helps merchants acquire new customers, close more sales, experience a lift in ticket size and increase profitability. Once the WeGetFinancing option is made available on a participating merchant’s website or brick and mortar store, customers of all credit types will be given the ability to apply for instantaneous financing while only providing a minimum amount of personal information. Because WeGetFinancing works with a multitude of banks and lenders and covers the entire credit spectrum, more customers will be approved and the featured business will experience an increase in the number of sales and ticket size. No need to sign up, integrate and manage multiple purchase-finance solutions. WeGetFinancing does it all as well as helps analyze participating merchants’ traffic to always offer the best mix of lenders to optimize conversion. Some of WeGetFinancing’s partner banks even offer promotional financing that may include programs with very competitive interest rates, such as 0% financing for up to 24 months.

-

Is WeGetFinancing compatible with other payment systems?

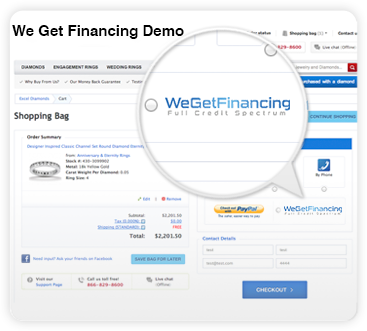

Yes. Through the easy to install API or using one of the many available 3rd party shopping carts plug-ins, WeGetFinancing seamlessly integrates directly into participating merchants’ shopping carts, becoming another payment option right next to Visa, MasterCard, American Express, Discover, PayPal, and more.

-

Does WeGetFinancing charge any fees?

No. WeGetFinancing does not charge any setup, activation or monthly fees. When you register with WeGetFinancing, you will have the opportunity to review all of the available financing programs based on your company’s profile, industry and average ticket size. You will then be able to view each of the lenders’ discount fees schedules for which your business qualifies, as well as any additional costs connected to special promotional programs which you may want to offer to your customers.

-

How does WeGetFinancing help me close more sales?

With WeGetFinancing on your side, you will be able to offer your customers of all credit types a diversity of financing options that match their credit profile. With a single and simple to fill-out application, your customers will be offered installment loans, revolving credit lines and leasing programs under the best possible terms. No need to sign up, integrate and manage multiple purchase-finance solution providers. WeGetFinancing does it all for you and helps analyze your traffic to always offer the best mix of lenders to optimize your conversion. Offering financing to your customers will not only cause an increase in conversion ratio, but will also create a lift in ticket size. Consumers who have more credit available typically upgrade their purchase. It’s a fact! Merchants, who let their customers know that financing is available at their store, experience an increase in traffic and in the number of closed sales.

-

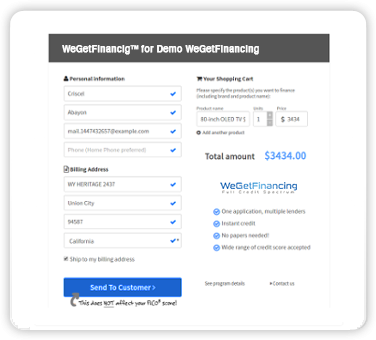

How do I get integrate if I have a call center / retail locations?

You can just login to your dashboard and you will be able to send the application to the customer's email or phone and let them complete it there. No integration is required. You have the option to receive automatic notifications and prepopulate applications from your CRM, but for most stores you can get started after being approved.

-

How do I get integrated if I have an ecommerce?

If you are using a standard shopping cart and we have a plugin for it, the installation is pretty much plug&play. If you have a custom shopping cart, we have a simple yet powerful API with some code samples that should get you started pretty fast.

-

How can I contact the WeGetFinancing Merchant Support team?

Email our merchant services specialists at merchantsales@wegetfinancing.com or call us at 1-866-298-3757 ext 2.

-

How do I get started with WeGetFinancing?

Simply go to WeGetFinancing signup page, fill out the quick registration form and select a good day and time to speak with one of our Merchant Account specialists. There is NO obligation to register.

-

Can WeGetFinancing approve all my customers for credit?

Although a high percentage of customers’ financing requests are approved through the WeGetFinancing Gateway, because of the diversity of requirements from the lenders and the broad spectrum of applicants’ profiles, not all applications can be guaranteed approval. We strive to approve as many applicants as possible and in order to do so; WeGetFinancing is adding more lenders to its platform on a regular basis. While your customer might have been declined today, please let him/her try again later as a lender that could approve him/her might have been added to the list of participating lenders at a later date.

-

What is the settlement process? How do I get paid?

If your customer is approved for financing and the lender has agreed to fund the transaction, you will be notified immediately both by e-mail and through the WeGetFinancing dashboard. At your brick and mortar store your customer will be able to take his/her purchase home immediately. If the transaction happened on your web store, you should ship the item(s) sold in accordance with the shipping arrangements selected by the customer at the time of the transaction once you have received the funding confirmation from the lender. Within two (2) business days following the funding of the transaction, the credit issuing lender will settle the amount of the sale directly into the designated bank account provided at the time of your merchant account application, minus the agreed upon discount fee. NB: If your customer was approved by one of our peer to peer lenders, the funds will be credited directly to the customer’s bank account and you will need to make payment arrangements with the customer directly prior to letting the customer take the merchandise home, or scheduling shipping.

-

Is there a minimum purchase amount in order for a customer to qualify?

Yes. While WeGetFinancing participating lenders have different minimum loan amount requirements, the general guideline is around $300.

-

What is the maximum purchase amount that can be financed by WeGetFinancing?

Because of the diversity of requirements from the lenders and the broad spectrum of applicants’ profiles, according to the industry that you are in, this question has actually 3 answers.

1. If your customer qualifies for an installment loan program, the maximum amount that can be instantaneously approved (depending on the participating merchant’s vertical) is between $35,000 and $100,000.

2. If your customer qualifies for a revolving credit program, he/she may qualify for a credit line up to $10,000.

3. If your customer qualifies for a lease to own program he/she may be credit eligible for up to $4500.

-

What is the WeGetFinancing cancellation or return policy for an item that was purchased using WeGetFinancing?

WeGetFinancing’s return/dispute policy is either 30 days from the day of purchase or based on the participating merchant’s order return and cancellation policy whichever comes first. Participating merchants must make sure that their cancellation and return policy is provided to their customers at all time by clearly posting it on their web site and/or through a merchant assistance toll free number. Please note that in the event the customer is not able to arrive to a resolution with the merchant, that they will have the option to contact the credit issuer and ask for procedures on how to start a dispute or charge back.

-

What are the Terms and Conditions needed to become a WeGetFinancing merchant?

To apply for a WeGetFinancing Merchant account, you will need to register and agree to the terms and conditions of WeGetFinancing's Merchant Agreement. Once approved by WeGetFinancing’s underwriting department, you will be required to agree to the T&C of each of the lenders for which you qualify. Additional supporting documents might be required by the lenders in order to support your application for a merchant account. Please note that there is no setup or monthly access fee to be paid in order to become a WeGetFinancing participating Merchant.

-

Can WeGetFinancing process an application through a mobile device?

Yes. Once you are integrated, processing a transaction is really simple from any mobile device, iPads, iPhones, Androids phones or tablets. WeGetFinancing mobile site allows the consumer application form to fit on any screen size. By answering a minimal number of questions, your customers will be able to choose from the biggest range of lending options available on the market, which means you will get more approvals and close more sales. All functionalities from a single platform.

-

How can I monitor my transactions?

Upon approval, you will be provided by e-mail with your login credentials to the WeGetFinancing back-office. Once logged in, you will have access to your individual merchant dashboard where you will be able to view and manage all your transactions in real time.